If such an ad campaign raised your unit sales from 6,000 to more than 7,000, it would be considered successful.

Raising your advertising budget by $5,000 per year would raise your fixed costs to $35,000 and your breakeven point to 7,000. This calculation can be used when considering the benefits of advertising. Increasing sales: Assuming breakeven unit sales of 6,000, increasing the number of units sold to 10,000 would boost profits by $20,000 (4,000 units at $5 per unit). Formula (s) to Calculate Cost Per Unit COST PER UNIT TOTAL COST / NUMBER OF UNITS Common Mistakes Assuming that costs per unit are stable.For example, a builder could source lumber from a lower-cost supplieror take advantage of equipment and/or technology to automate production. Variable Cost Per Unit Total Fixed Cost If you have a total sales amount and quantity of sales, then you can easily get the average per-unit sales price by dividing the sales amount with the sales quantity. Lastly, the sum of total fixed cost and total variable cost calculated in step 3 is to be divided by the total number of the units produced during the period as. Average Variable Costs 300,000 400 750 Therefore, average variable costs are 750 per unit. We can calculate the average cost by dividing the total cost by the total.

#Variable cost per unit calculator online how to#

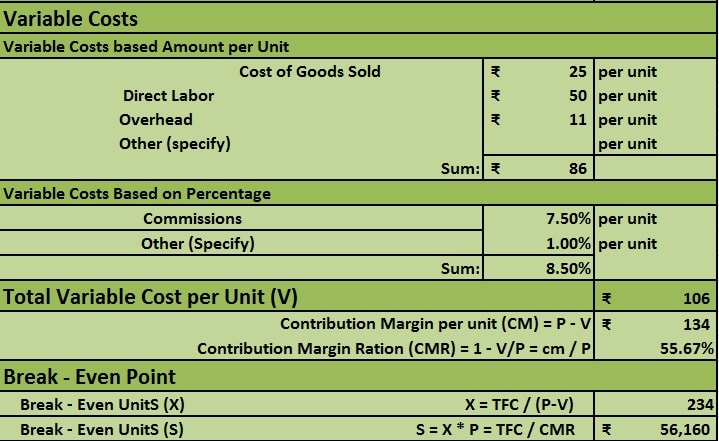

Variable costs typically are lowered by reducing material or labor costs. Variable cost formula: Total Variable Cost Production Volume x Cost Per Unit For example, if it costs 50 to make one unit and a factory has produced 20 units throughout the month, then the total variable cost for that month is 50 x 20, or 1,000. Formula How to calculate AVC Average Variable Costs Total Variable Costs Quantity Example Total variable costs are 300,000 and 400 units are produced. Average Cost, also called average total cost (ATC), is the cost per output unit.

#Variable cost per unit calculator online free#

Increasing the selling price: Staying with the example of $12 widgets, increasing the selling price by $1 reduces the number of units you need to sell by 1,000 based on a new calculation: $30,000/($13-$7)=5,000. Here is a free online High-Low Method calculator to calculate the variable cost per unit, fixed cost and cost volume with ease and simplicity based on the.

0 kommentar(er)

0 kommentar(er)